News

More »

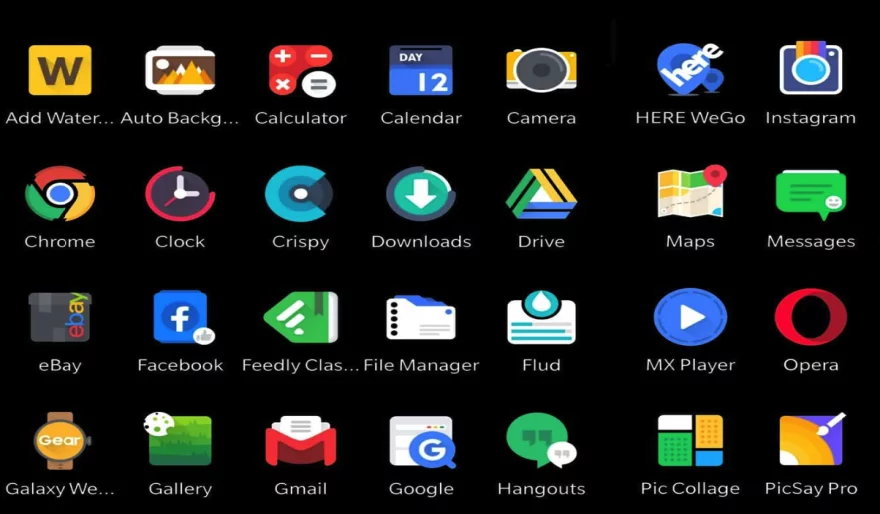

Popular Apps

Trulia: Homes For Sale & RentTrulia

CoStar Commercial Real EstateCoStar Group

Zoho Analytics - DashboardsZoho Corporation

WhatsApp MessengerWhatsApp LLC

REALTOR.ca Real Estate & HomesCanadian Real Estate Association

Apartments.com Rental Search aApartments.com

RealMaster - Real EstateRealMaster Technology Inc.

SMS Theme Rabbit Fluffy PinkThemes for Launcher Keyboard SMS Dialer

Real Estate in Canada by ZoloZolo.ca

MessengerMeta Platforms, Inc.

![[WISH] 별이 빛나는 밤 카톡 테마](https://apkpro.com/images/17117172399755804.webp)